Liquor, after the implementation of Goods and Services Tax (GST) was kept out of it. It comes under state subject, Under Seventh Schedule of Constitution of India. So, every State has the power to frame a Liquor Policy. States apply Excise Duty on liquor and some states also charge Value Added Tax (VAT) on it. Liquor is one of the most important instruments to generate revenue for the State Government.

Delhi came up with a new Liquor policy named as New Excise policy of 2021 but in 2022 this policy has been withdrawn, due to allegation of undue benefit to some private person by Government Officials.

But Here we are going to discuss the State which banned the Liquor in the name of Social Engineering and social benefit. We are also going to find out how it has an impact on the economy and Revenue.

Liquor Policy of Ban

Liquor is a great source of Income for any State in the form of Excise Duty and VAT. But, to implement DPSP under Article 47(Prohibition of intoxicating Drinks) various State Governments have banned the Sale, Production and Consumption of Liquor. This can be seen as Liquor Policy of ban. There are few States and Union Territories Which banned the Liquor. These are :-

Gujarat

The Bombay Prohibition Act 1949, prohibits the sale, purchase and consumption of liquor. In 1960, after the creation of Maharashtra and Gujarat, this law continued to exist. But there are certain special permits for the consumption of alcohol. Like tourists, foreigners, people suffering from special medical conditions. These purchases are done from Government’s authorized Liquor shops. On the other hand Certain clubs, hotels, and international guests are eligible to apply for Licenses. A kind of liquor Tourism.

Read about Lorem Ipsum

Bihar

Under Bihar Prohibition and Excise Act, 2016, in April 2016 Bihar Government Completely banned the sale, purchase, production and consumption of Liquor. The residents and non-residents are treated alike in this act. The objective of this policy is to trickle down alcohol related problems like poverty, domestic violence, and health issues.

Nagaland

Under Nagaland Liquor Total Prohibition Act, 1989, the state totally banned sale, manufacturing, possession and consumption of Liquor. In Nagaland Liquor prohibition is a part of a movement, various social organizations, Women’s groups and churches demanded the ban on liquor. So, here it was an upward or people demanded Liquor policy, to address issues like domestic violence, public health and social disruption.

Lakshadweep

Except Bangaram Island, alcohol is banned in the whole group of islands of Lakshadweep. Selected Resorts and tourist spots have the availability of alcohol. The ban on Liquor is mainly to uphold the cultural and religious sentiments of local people. Majority of Lakshadweep belong to Muslim community, that’s why prohibition is implemented that way and Liquor Policy is designed specifically.

Mizoram

The history of Liquor Policy of Mizoram lies between banning and lifting the ban. Mizoram Liquor Total Prohibition (MLTP) Act banned the sale, possession and consumption of alcohol from 1997 to 2015. After this Mizoram Liquor (Prohibition and Control) Act or MLPC Act lifted the ban. And again Mizo National Front (MNF) Government in 2019 re-imposed the Ban on Liquor under the Mizoram Liquor Prohibition Act. Few exceptions are there for specific medical conditions.

Manipur

The Liquor ban in Manipur is also a part of women’s movement Meira Paibis (women torch-bearers) and many religious organization’s participation. The concern about alcohol-related violence, addiction, and health issues made them take such action. With these efforts the Manipur Liquor Prohibition Act 1991, enforced a ban on the sale and consumption of alcohol. In 2022 Government Partially lifted the ban by taking Tourism and Businesses. While some groups are still opposing the action.

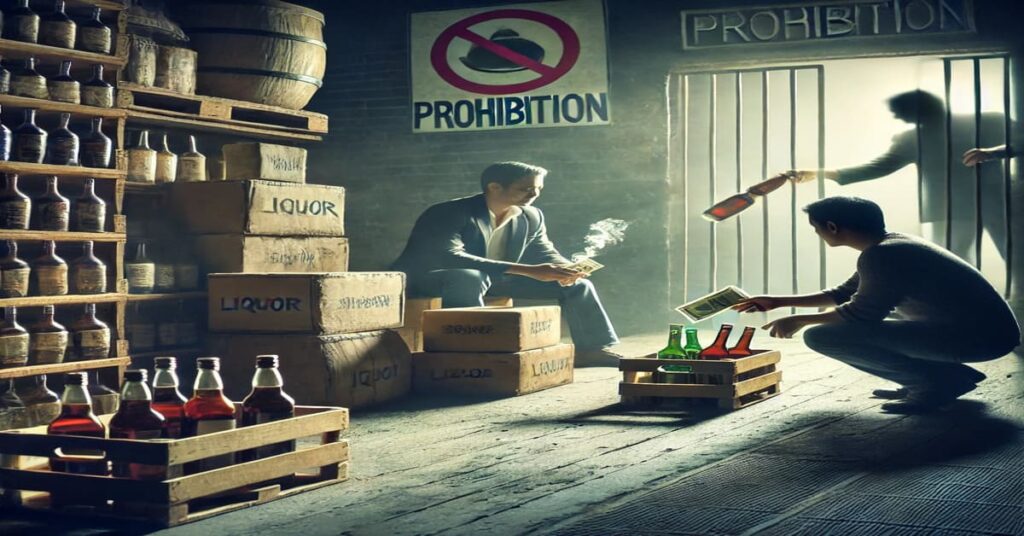

The Issue of Illegal Trade

If you are a Bollywood lover then you have seen/heard about Movie Raees, Which depicts the illegal Businesses of Liquor. Apart from this, the issue is of huge concern. There are few events/questions which can explain the negative impact on the public.

- Are there any increase in the sale of Liquor in the neighboring state of the state having Liquor policy of ban? If yes then, maybe Liquor is illegally transported. The liquor is already taxed in neighboring states and re-taxed by the middle man as a Service Charge. If state machinery is involved in this then the Liquor is Toll taxed.

- Taadi or Toddy, collected from a Palm tree. Irony is, production and consumption of fresh Toddy is legal and when it gets fermented it becomes illegal. You can imagine how easy the implementation of prohibition is. If Toddy-Tapper gets any rebate from local officials, then this time he pays the Value addition (VAT) of fermentation.

- Illegal manufacturing of alcohol is also a serious concern and without political back support it is not possible. This issue is not particular to the state having Liquor ban but others too. This time a non-state actor charges the Excise Duty.

- If anyone is found guilty of consumption of liquor, this time the tax becomes direct.

So, we have various indirect tax as well as direct tax which can be the result of Liquor policy which bans Liquor.

Conclusion

Liquor and such Liquor policies always create dialectics in the mind of the Government. On one hand it is a source of Thousands of Crores of revenue on the other hand Social issues create hurdles for Liquor. Where the execution of Liquor policy is efficient, society may see the development. But, if the implementation is not up to the mark then, we can see it as a double edged sword or a single Bullet hitting the two Aims.